Is Commercial <b>Real Estate Investing</b> In Your Future? - FortuneBuilders | Real Estate Investing |

- Is Commercial <b>Real Estate Investing</b> In Your Future? - FortuneBuilders

- Ping An Real Estate | Chinese <b>Real Estate Investors</b> NYC

- <b>Real Estate Investing</b> is St Louis Missouri | Freedom Real Estate <b>...</b>

- Should You <b>Invest</b> in Stocks or <b>Real Estate</b>? - Modest Money

- <b>Real Estate Investment</b> Income Report: Here's What I Earned in <b>...</b>

| Is Commercial <b>Real Estate Investing</b> In Your Future? - FortuneBuilders Posted: 18 Jan 2016 12:00 PM PST There are many different ways to invest in real estate. While you can't be expected to master all of them, you should have a basic level of understanding of how each of them works. That said, one of the more intimidating areas of the business is commercial real estate. People tend to think that more units translate into more work and more hassle. Moving from a single-family residential property to a 15 unit apartment building will certainly have a different set of challenges, but it is far from impossible. Like any other exit strategy, you need to spend some time understanding exactly what you are getting into. Once you feel comfortable and are ready to move forward, you will find that commercial properties can completely change your portfolio. If you have been on the fence with commercial real estate, here is a quick guide to help you get started. By definition, a commercial property is any property between five and twenty units. It can also be a combination of a mixed use property coupled with a storefront. Because of the wide range of units, there is no difference in guidelines between a five unit property and a fifteen unit apartment complex. As simple as it sounds; if you are going to own five units, why not own fifteen? Once you move past a single-family property, you own to scale; everything associated with the property is under one roof. There is one yard, one roof, one building and parking lot. Managing these units is usually done by a full-time property manager that will charge the same fee, regardless of the number of units. The point is this; if you are going to make the move to commercial and mixed use properties, you might as well dive in with both feet and go for as many units as you can afford. I encourage you to think long-term with any commercial real estate property. For starters, the purchase process will take several months. Even if you have access to capital and can offer cash, performing due diligence is a lengthy process. To maximize your returns, you need to hold onto the property for a significant period of time. Your break even point may not be for several years. If you decide to sell before that time, you may have trouble finding the right market to sell in. Commercial properties require a unique buyer; one that has capital and the right mentality. Before you decide to do anything with a commercial property, you need to accept that it will be a long-term hold. If you are not thinking about the long-term prospects, a commercial property may not be the best purchase for you. Running the numbers for a single-family rehab or multifamily rental property is pretty straightforward. There are a few basic expenses and formulas that almost every transaction looks at. When you get to five plus units, you need to look at a different set of criteria. No longer are you buying based on the property value; you are buying based on the projected income you can generate. Like any other property, location is the most important feature with a commercial property. If your property is not in demand, you won't find tenants and you will be stuck with vacancies. You need to stay on top of cap rates, vacancy factors and net operating income. Learning these formulas can be confusing and frustrating at times, but they hold the key to commercial investing success. Find a real estate agent who specializes in commercial properties. They can help guide you on all of the numbers and formulas you need to know. Financing for a commercial property is completely different than financing for even a four-family property. For starters, you are limited as to the number of available lender options. Most lenders require a minimum of 25% down, with some as high as 30 percent. Commercial properties are considered a higher risk factor than a single-family, and have higher interest rates and increased guidelines. Every unit is scrutinized and evaluated as part of the approval process. The down payment money must be seasoned for a longer period of time, and typically credit scores need to be much higher. If you have any interest in buying commercial properties, you need to set up financing as quickly as possible. A commercial purchase has a different set of costs than a single-family property. There is increased due diligence that needs to be done, even before you are ready to make an offer. Where a normal title search may cost you $500, a commercial property will be three times that. All of the costs associated will be much higher than you expect. It is not uncommon for a ten unit appraisal to be as much as $2,000. The same is the case with the inspection and other fees. These costs vary from lender to lender, but as a rule of thumb you will need much more money upfront with a commercial purchase. Commercial and mixed use buildings offer something completely different for your portfolio. There is definitely a different set of rules, guidelines and information. However, once you master them, a commercial building will change how you look at real estate investing. |

| Ping An Real Estate | Chinese <b>Real Estate Investors</b> NYC Posted: 07 Jan 2016 12:20 PM PST Ping An set to invest "billions" through new US real estate armChinese insurance giant "absolutely" looking at New York market: Singer January 07, 2016 03:20PM From left: Peter Ma and Rick Singer Having ramped up its investment in global real estate markets over the past two years, the real estate arm of Chinese insurance giant Ping An is set to invest "billions of dollars" in the U.S. over the next several years – with New York City set firmly in its sights. PARE U.S., Ping An Real Estate's U.S. real estate investment arm, officially launched late last year with Rick Singer, former head of global real estate at Salomon Brothers, as its chief executive. The new venture will handle "all of the [real estate] investing for Ping An in the U.S. going forward," Singer told The Real Deal. "The purpose is to consolidate the decision-making and process of deal flow to a local basis, so that Ping An can be much more active in investing in the U.S.," Singer said of the PARE U.S., which aims to differentiate itself from other Chinese forays into the U.S. real estate market through the "benefit of local expertise." The firm will not only focus on development projects but other forms of real estate investment, such as structured debt deals, asset portfolios and even entity-level acquisitions. It aims to invest "billions of dollars [in the U.S.] over the next two to four years," Singer said. "To move the needle with Ping An, it takes that." Ping An's U.S. real estate presence thus far has been outside of the New York market, having partnered, alongside fellow Chinese insurance giant China Life, with Tishman Speyer for a stake in the developer's $500 million Pier 4 waterfront development in Boston. But Singer said the new venture is "absolutely" looking at New York as part of its strategy to invest in core urban areas – citing the city as "the biggest and most important" of those core markets. PARE U.S. is actively in "discussions with many of the large developers in New York," he said, citing its "ongoing relationship with Tishman Speyer," as well as conversations with the likes of Silverstein Properties. "In building up this business, our focus is very much to do things off-market and quietly, based on relationships," Singer noted. "To do it in a way where we're very much like a U.S. investor, as opposed to a foreign investor." Ping An, China's second-largest insurer with more than $700 billion in total assets under management, has made waves with the ventures into global real estate markets in recent years, having acquired two London office properties in deals valued at nearly $900 million. It purchased the iconic, Richard Rogers-designed Lloyd's of London building for $390 million in July 2013, and followed that with the acquisition of the Norman Foster-designed Tower Place for around $490 million last January. With PARE U.S., however, the company looks set to follow Chinese insurance giants like Anbang Insurance Group and Fosun International in betting on U.S. real estate – and staking its claim in New York, as well. "It's a very smart move for Ping An to venture with local U.S. expertise in Rick Singer," Eastdil Secured senior managing director Doug Harmon told The Real Deal. "I think it will for sure help them navigate the markets in a swifter, smarter fashion." |

| <b>Real Estate Investing</b> is St Louis Missouri | Freedom Real Estate <b>...</b> Posted: 17 Jan 2016 07:00 PM PST In their first couple years they have flipped about 25 hours and acquired 30 cash flow rental units! Our guests today are Rob Heyder and Jonathan Rankin. They are real estate investing partner in St Louis Missouri and they are absolutely getting after it! One of the things that you will enjoy most of this Episode is that these guys really treat investing as a real business, and their results are the proof in the pudding! They are going to share how they work together, who is responsible for each process in the business and their Freedom goals that they are both working towards! You can connect with them at www.CorePropertiesSTL.com. Listen to how Rob & Jonathan are working towards Freedom through Real Estate Investing, and be sure to Subscribe in iTunes for Free daily updates! 3-Minute Video Shows You How Online Training Event! Discover how to acquire houses and income properties with No Money Down Strategies. Online Training | Enroll Now to Reserve Your Spot |

| Should You <b>Invest</b> in Stocks or <b>Real Estate</b>? - Modest Money Posted: 22 Jan 2016 08:00 AM PST Investments are a great way to make some extra money. Two of the most common investments are real estate and investments in the stock market. The good thing about each of these kinds of investments is that, in addition to providing a good return, they're both very flexible. If you want a long term investment that requires very little day to day attention, they both have options that can do that. At the same time, if you want a short term investment or an investment that requires daily decision making; they both offer options for that as well. So, now all that is left is to decide which investment you prefer personally or you can decide to invest in both. Although both are great investment methods, it's probably best to start small with stocks. Investing in real estate is a much bigger commitment. Investing in the Stock MarketBefore investing in the stock market, you're going to want a lesson in smart investing. If you're not properly trained in making smart stock trades, you could lose everything. There are qualified professionals out there who have your best interests at heart and can teach you to make smarter stock market investments, such as at Simpler Trading. The stock market offers many ways to invest your money. There are many great options for long term investments that require relatively minimal attention, such as buying stocks long. Stocks that you buy long can provide dividends; and limited risk, as you are only risking your initial investment. The stock market also comes with short term investing options. If you are looking for a quick investment that requires more attention, then you can sell short. This offers a chance for a higher rate of return. But it also has more risk, as your potential losses can be unlimited. You can even buy stock options to balance your risk as you see fit. With all the different stock market investments available it is important that you become as educated as possible before you make an investment; this way you can choose the option that is best for you. Learn how to trade smarter today risk free! Find winning trades in minutes! Investing in Real EstateSimilar to the stock market, real estate offers many different investing opportunities. You can make long term investments in real estate investment groups or in a real estate investment trust (REIT). Here the investment is long term and requires minimal day to day attention. Or you can invest in long term investments that require significant daily attention. For example owning rental properties; where you must manage the property and the tenants. Then there are relatively short term real estate investments (ideally less than a year), such as real estate trading or flipping houses. But this requires substantial daily attention for the entire length of the investment. Just like any other investment, it is important to remember that real estate investments come with their own set of risks. To be successful you must educate yourself on these risks and manage them wherever possible. Stocks vs. Real EstateWhen deciding whether to invest in real estate or stocks, it all comes down to personal choice. Stocks are easier to liquidate, meaning that it is easier to turn a stock investment into cash than it is a real estate investment. Once you sell a stock, cover a short sale, or act on an option; the investment is turned into cash. Stocks can even give you cash without being sold, in the form of dividends. With real estate that is not typically the case. Selling a property or "flipping" a house can be a long process. You need to find a buyer, consult a broker, and complete the sale. So it can take a very long time before actually you see any returns on your investment. Choosing Your InvestmentWhen it comes to investing, it's all about personal preference and comfort. Some people are more comfortable with real estate because it is tangible. Other people prefer stocks because they are more liquid and offer more flexible options. But, regardless of the type of investment you choose, you should remember that all investments come with risk. So it's important to educate yourself as much as possible and seek professional guidance whenever necessary. This will help you to mitigate your risks and make the best possible decision for yourself. Trade Stocks from Modest Money Recommended Brokers |

| <b>Real Estate Investment</b> Income Report: Here's What I Earned in <b>...</b> Posted: 12 Jan 2016 12:03 PM PST How much income did I earn through real estate investing last month? And how much time did it take? I'm back for another round of baring my financial books to the world. Ready? If you're new to this website, here's a quick synopsis: I own 7 rental units, and I spend a great deal of time teaching people how to develop their own rental property portfolio. (Actually, I spend my time cracking jokes about Steve Harvey and posting cute cat photos. And once in awhile I throw in something semi-intelligent about real estate, too.) I hear from many readers who hold the same misconceptions, excuses and limiting beliefs:

Oh wait — I said that last line. Anyway – Rather than trying to explain confounding concepts like "no, I don't plunge toilets at 2 a.m.," and "seriously, I don't do that," I figured I'd show the complete behind-the-scenes picture. Here's exactly:

Take a look at the numbers and decide for yourself if you're interested. A few notes:

Alright, let's get down to business! December Gross Income: $9,259.27Last month, the rental properties collected a total of $9,259.27. If I were some spammy real estate guru, this is the point where I'd show you a photo of myself holding an oversized novelty check. Then I'd cut off the conversation here, with no mention of the expenses. Please don't listen to anyone who does that. Here's the breakdown, with commentary:

House #2: $200.50 — See note below. Oh Yeah, One More Thing:Last month we deposited two small refunds:

Our bookkeeping software classifies refunds as "income," which is why the screenshot below shows gross income of $9,316.43. Not a big deal, but wanted to mention it for clarity's sake. If you're wondering why House #2 shows a paltry $200 in rental income: My property manager subtracts the cost of repairs, maintenance, new appliances, etc., plus her management fee, and sends me whatever is leftover. House #2 needed three windows last month, at a total cost of $650. After subtracting for windows plus her normal management fee, the leftover amount — the "income" — totaled $200.50. Wheee! #DrinksAreOnMe By the way, this is why I'm styling these reports as actual cash flow. If I were like, "I brought in $X, and I'm saving $Y for big-ticket repairs," then later — when I spend $650 on windows — I'd have to re-adjust all the numbers. Otherwise, the windows would be counted twice. And if I said, "I'm also saving $Z in case of vacancies," then later — when I have a vacancy — I'd again need to re-adjust the numbers. And that would turn into a huge spaghetti tangle. That's why I've chosen to show you cash flow. Speaking of which — What OTHER expenses did we incur? Mortgage: $3,524.03

Mortgage, Part II: $583.33

Utilities: $164.16

Equipment Repairs: $116.30

Property Repairs: $29.03

Bank Fees: $3.00

The insane part is that I know there are better business banks — heck, the Afford Anything LLC account is at a different institution — but I haven't gotten around to switching. I'm too busy watching Downton Abbey reruns. So instead, we continue our monthly fee-then-refund dance. How uncivilized. Total Expenses (Including Debt Servicing): $4,419.85 Cash in My Pocket: $4,895.58Total net cash flow came to $4,895.58 after paying all expenses, including the mortgages. Hooray! #MaybeDrinksReallyAREonMe Bear in mind, this is a cash flow report, intended to showcase monthly volatility. That's a nerdy way of saying "Some months will suck. Others will make you feel like a baller. Join me every month for the full-throttle rollercoaster experience." This is a good month: no vacancies, no major renovations, and our mug shots haven't been featured on the nightly news. During these good months, stockpile cash so you'll be prepared for the bad months. It's not all daisies and kittens. How Much Time Did This Take? (Spoiler Alert: 5 Hours, 30 Minutes)How much time did Will and I spend in pursuit of this $4,895? Here's exactly what we did: Total: 5 hours, 30 minutes (including commute time) I don't know if you want to count this, but I also spent about 30 minutes shopping for a holiday present for my contractor. He got champagne and dog toys. (Seriously.) We earned $4,895 with 5 hours, 30 minutes of work (or 6 hours, if you count shopping for booze + puppy treats). You could describe this as roughly $906 per hour. But that's silly. Passive income investments are created to stop trading time for money. I'm not making $906 as an hourly rate; at this stage in the game, the hourly rate formula flies out the window. This is what can happen when income derives from capital rather than labor. A few notes:

Questions, I Have Questions!You're probably wondering:

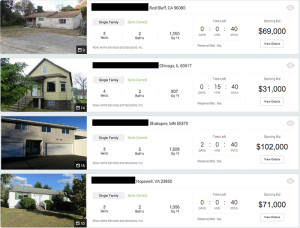

Here's the thing: Some of you have been reading me for years. You already know the answers to questions like "what did the properties cost?;" you were there (as a reader) when I bought them. Others just discovered this website last week. All of this is new. So I'm tasked with the twin goals of (1) answering questions, while (2) not boring my longtime readers. Solution: The Ultimate FAQ Page. This is a living, dynamic list that'll keep growing. The more questions I get, the longer this page will grow, until eventually the Internet runs out of space. The Search for House #6 Begins … and EndsI'd like my next property to be in Atlanta, rather than Las Vegas where I live, for one simple reason: I've already built a team there. If I need a plumber, electrician or HVAC installer, I know who to call. I spent a week in Atlanta in December, kicking off the search for House #6. And for the sake of keeping y'all in the loop, I tracked my time with the toggl app. Here's what it looks like: Searching for House #6 consumed: And resulted in:

I've never tracked my time searching for a property (from start to finish), but I wouldn't be surprised if I spent 100+ hours for every house that I buy.

Yeah. You know how I always say that passive income is not free money? In order to create the incredible benefits that I enjoy today, I front-load the workload. Work hard today; reap rewards for years. It's like planting seeds in a garden. Tilling the soil is a pain-in-the-butt, but you get awesome tomatoes all summer long. Here's exactly how I search for properties: First, I narrow my focus. It's easier to spot trends and contextualize prices if you specialize in a narrow geographic niche. I picked a couple of zip codes, using strategic and specific criteria. For House #6, I looked for the following:

Start small. Expand later. I can't search for multiple types of properties simultaneously. I focus on ONE type of property. This is a systematic approach.

These next two points are critical:

In other words, I want to buy the property for roughly 20 to 30 percent below market value.

Foreclosures, short sales, estate sales, driving for dollars, sending mailings to the owners of vacant houses, foreclosure auctions.

Only if you're bouncing from idea to idea. When I search for a property, I methodically work through a zip code, step-by-step. Overwhelm comes from a lack of planning.

Yep! I'm looking for an 8 percent Class B cap rate (or a 7 percent Class A cap rate.) If I invest $70,000 into a house that rents for $900 per month, assuming $400 of monthly operating overhead and 5 percent vacancy, I'd have roughly an 8 cap property. (It's a 7.8 percent cap rate, which is close enough for my purposes.)

In a nutshell:

In December:

Yep. If a property purchased with an FHA-insured loan gets foreclosed upon, the federal government (Housing and Urban Development, or HUD) will repay the defaulted loan and then sell the house. These properties are listed at HUDHomeStore.com and they're a gold mine for investors — but they're also competitive. Preference goes to owner-occupants, and HUD will only sell to an investor if they can't find a qualified primary resident. There are other risks, as well, which are beyond the scope of this article, but suffice to say that HUD can be a great opportunity if you're patient and strategic. I made an offer on a HUD home. They countered with a price I wasn't willing to pay. Ultimately I walked away.

Yep, I got into a minor bidding war over a property that I toured. It came down to myself vs. one other bidder. I knew how high I was willing to go — and the other bidder was willing to go higher. In those situations, it's tempting to raise your bid. "What's another $2,000?" But I held strong. I ran the analysis. I knew my final price. And I knew when to walk away. In fact, I physically shut down the laptop and walked away. Real Estate Course … Coming Sometime!That brings us to today. I can describe the deep inner workings of my brain in four points:

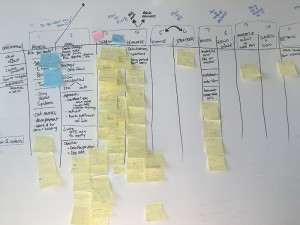

Here's a snapshot of my home office: (Apparently I missed the memo that I'm allowed to write directly on the whiteboard.) Here's what I realize: There's a difference between knowing a skill and knowing how to teach a skill. I'm deep in the throes of trying to understand the latter. It's not enough to just present information. This needs to rise above-and-beyond. How do I design course material in a way that keeps students engaged? Motivated? More importantly, how do I design curriculum that results in students taking action? Changing lives? I can't just say, "this is how to calculate cap rate." You can learn that in five seconds of Googling. Heck, you can learn that here, for free. That's not enough. The problem facing most of my readers isn't a lack of information. It's a lack of a system that can convert information into action. Students can't graduate from the course as (merely) knowledgable people. My goal isn't to help people win Trivial Pursuit: Real Estate Edition. That would be a colossal failure on my part. My goal is to develop students into successful rental property investors. I want graduates to send me emails saying: "Guess what? I'm bringing in my first $800 per month in net rental property passive income!" #DrinksAreOnThem !! So I need to design curriculum that can lead to real, tangible results. In service of this, I've been spending a lot of time learning how people learn. (If you're interested in this topic, I highly recommend Julie Dirksen's book Design for How People Learn After deep-diving into this field, I've figured out that this course needs to be:

In short, this course is occupying every iota of my time, attention and energy. Here's how I'm clearing space for this:

I want this to be effective. And I'm willing to put muscle behind that goal. I've also decided to put the search for House #6 on hold for the moment. Searching for a rental property requires mental space, and I want to devote 110 percent of my mental space to creating the world's most badass English-language residential rental property investing course. I don't know when the course will be ready, because I'm not going to rush it. I'd rather be slow-and-great than fast-and-average. Sign up here to join the VIP List for special announcements about the course release. Get a handle on this "money stuff" ...... so that you can enjoy your life. Success! Now check your email to confirm your subscription. |

| You are subscribed to email updates from Real Estate Investing - Google Blog Search. To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 1600 Amphitheatre Parkway, Mountain View, CA 94043, United States | |

Glad to read the informative content get best Real estate marketing services

ReplyDelete